Before packing, check this list of items prohibited from entering a particular country or region.

Quick Tips![]() A BSF186 form must be completed

A BSF186 form must be completed ![]() You must attend a Canadian customs office to clear your items

You must attend a Canadian customs office to clear your items

Things you need to know when shipping to Canada

You will need to log into your account in order to complete our online documentation which includes:

- Inventory, recording the contents of your shipment;

- Insurance to protect your shipment in case of mishap.

You will need to upload scans of your passport - the picture page, the signature page and if applicable, a copy of your visa, at the final stage of the process.

There are helpful pointers all throughout but you must be completely accurate with the information you enter as these forms will be presented to the authorities at the destination.

You must be present in Canada when your shipment of personal effects arrive in the country.

Importing your personal effects and household items

Your shipment of personal effects and household items can be imported duty-free if:

- You are a returning Canadian citizen or recent immigrant:

Ideally, all personal effects or household items should have been owned and used for at least 6 months prior to you importing them. Some new items may be imported duty-free but others may be subject to duty and taxes. - Canadian citizens only: you must have lived outside Canada for a period not less than 12 months, you may be required to produce documentary evidence including:

a. Evidence of disposal of property abroad.

b. Cessation of employment

c. Evidence of "day to day" living:

• Bank statements;

• Utility bills (electricity, gas);

• Rent receipts;

• Medical insurance documents and

• Any other documents you think relevant and ideally cover the

12-month period or longer.

Please keep these types of documents should Customs require further information. - You are a student or visitor or entering with a work permit:

a. All personal items and household item must be for your personal use during your stay;

b. All such items must be exported when your temporary residence ends;

c. None of items imported can be sold or otherwise disposed of without Customs agreement.

All returning Canadian citizens or recent immigrants should complete the BSF186 form, "Personal Effect Accounting" document AND have it stamped upon arrival at the airport RED channel to avoid taxes / duties.

Please email the clearance document to our office UNLESS you are living in the Ontario area, then please mail the original clearance document.

What happens next

You must be in Canada when your shipment of personal effects and household items arrives. Upon arrival of your shipment you will be contacted by our office in Canada to confirm arrival and that we are awaiting clearance by Customs. This must be performed by you in person.

Our office will email you the necessary documents and clear instructions how to complete these documents. These documents must be presented to Customs office in the city where your cargo is located – the Customs office may not be local to you. Once your shipment is cleared, Customs will stamp your “Cargo Control Document” as “PARS PERMITTED”.

Please email the clearance document to our office UNLESS you are living in the Ontario area, then please mail the original clearance document. Once this has been received we will contact you to arrange the delivery of your shipment.

Canadian customs process - video explainer

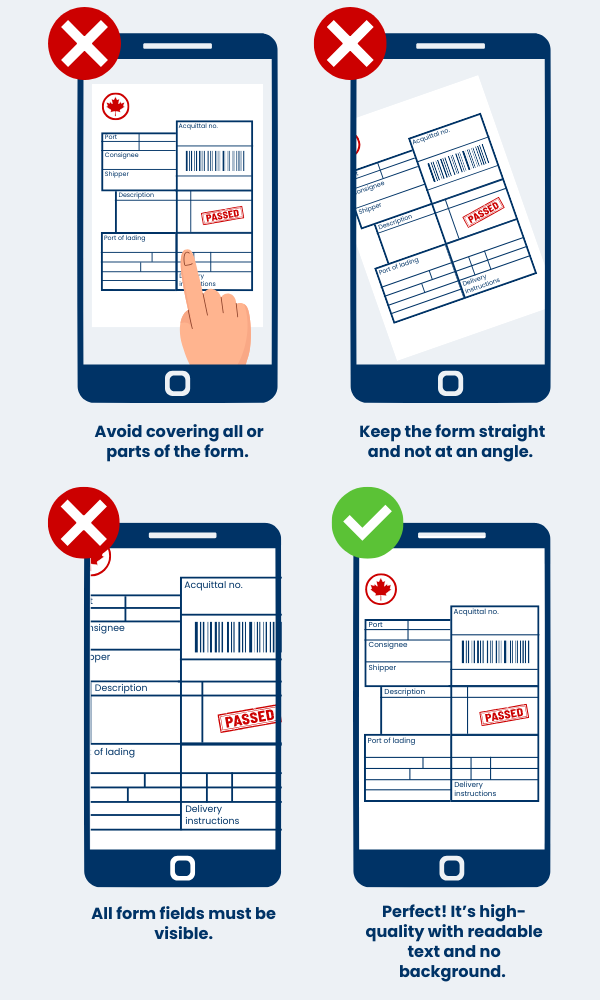

When taking a photo of your Cargo Control Document (CCD), ensure there is no background, the form is straight, and all fields and text are visible and legible.

Importing wedding gifts

Your wedding gifts can be imported duty-free provided they are part of your shipment of personal effects and household items. In addition to completing our online documentation you will need to provide a copy of your marriage certificate.

Importing inheritance items

Your inherited items can be imported duty-free if you can provide a copy of the death certificate; a letter from the executor stating you as the beneficiarywith list of items inherited.

Importing works of art and antiques

You can import works of art duty-free as part of your shipment of personal effects and household items.

Prohibited goods

We make importing into Canada easy. See our comprehensive list of items you cannot send to Canada along with any service based restrictions.

Canada Border Services Agency (CBSA) Customs Offices in Canada

We will contact you again shortly before your shipment arrives in Canada to advise you which CBSA Customs Office you must visit to clear your shipment. This Office is local to the bonded warehouse that will hold your shipment and that may not be "local" to you unfortunately. If you are either a Canadian national, a permanent resident or "soon-to-be" permanent resident, then you will need to complete online and printed off a BSF186 form before you arrive and have it stamped by Customs at the airport.

Alberta

Calgary Customs Office

175 Aero Way Northeast, Unit 162,

Calgary, AB T2E 6K2

Monday- Friday 8:.00 AM - 4:00 PM

Sat. & Sun. - Closed

Edmonton Customs Office

1727 35th Ave East Unit 100

Edmonton, AB T9E 0V6

1 800 461 9999

Monday- Friday 8:.00 AM - 4:00 PM

Sat. & Sun. - Closed

British Colombia

Vancouver Customs Offices

1611 Main Street Unit 412

Vancouver, BC V6A2W5

204 983 3500

Monday- Friday 8:.00 AM - 4:00 PM

Sat. & Sun. - Closed

Manitoba

Winnipeg Customs Office

1821 Wellington Avenue Unit 130

Winnipeg MB R3H 0G4

204-983-3030

Monday- Friday 8:.00 AM - 4:00 PM

Sat. & Sun. - Closed

Nova Scotia

Halifax Customs Office

163 Susie Lake Crescent

Halifax, NS B3L 4V6

902 426 2072

Monday- Friday 8:00 AM - 4:00 PM

Sat. & Sun. - Closed

Ontario

Mississauga Customs Office

2720 Britannia Road East

Mississauga, Ontario L4W 0G3

OPEN 24/7

905 676-3626

Quebec

Montreal Customs Office

400 Place d'Youville

Montreal, QC

514 283 8700

Monday- Friday 8:.00 AM - 4:00 PM

Sat. & Sun. - Closed

Saskatchewan

Saskatoon Customs Office

2625 Airport Dr

Saskatoon, SK S7L 7L1

306 975 4755

Monday- Friday 8:.00 AM - 4:00 PM

Sat. & Sun. - Closed

Regina Customs Office

2510 Sandra Schmirler Way

Regina, SK S4W 1B7

1 800 461 9999

Monday- Friday 8:.00 AM - 4:00 PM

Sat. & Sun. - Closed

Bonded warehouse addresses

Here are the addresses of the bonded warehouses in Canada we will use to safely store your shipments while you arrange customs clearance.

Calgary

Fastfrate

11440 – 54th Street SE

Calgary, Alberta

Canada T2C 4Y6

Tel: 403.264.1687

Edmonton

Fastfrate

10020-56th Avenue

Edmonton, Alberta

Canada T6E 5L7

Tel: 780.439.0061

Saskatoon

Direct Distribution

3030 Cleveland Ave

Saskatoon, SK

Tel: 306-956-1760 x 38804

Montreal

Lafrance Warehouse

7055 Notre-Dame St. East

Montreal, Quebec H1N 3R8

Tel: 514 523 1127

Simard Warehouse

1212, 32nd Avenue

Lachine, QC H8T 3K7

Tel: 514 636 9411

Halifax

I. H. Mathers

165 Burbridge Ave.

Dartmouth, NS, Canada B3B 0G6

This page was last updated on 22nd November 2022.

This page was last updated on 22nd November 2022.

Don't take our word for it